The REAL Legacy of Columbus

“World War I.” That title should rightly go to the first true global conflict, Europe’s genocidal invasion of other regions that began in the final decade of the 15th century after Columbus landed on Hispaniola in 1492. While European historians have often downplayed the ferocity, extent and significance of that earlier conflict by treating it as a diffuse historical process, but if we accept that view it disables our understanding of everything that has happened since then.

Columbus never set foot in the land that would become the United States of America. In fact, he never even saw it. As few are likely to know much about what really happened, I will recount some salient points…

His four voyages took him to the Caribbean, a small detour to Central America, and a hop to the north-east coast of Venezuela. He had no idea the continent of North America existed, or that he had even stumbled into a “New World”. He thought he had found China, Japan, and the region of King Solomon’s fabled gold mines.

What he had categorically not done was “discover” anything, as somewhere between 50 to 100 million people already lived there quite happily, just as they had done for tens of thousands of years. On the other hand, what he did was to start a brutal slave trade in American Indians, and usher in four centuries of genocide that culled them to virtual extinction. Within a generation of Columbus landing, perhaps only 5-10 per cent of the entire American Indian population remained.

What he had categorically not done was “discover” anything, as somewhere between 50 to 100 million people already lived there quite happily, just as they had done for tens of thousands of years. On the other hand, what he did was to start a brutal slave trade in American Indians, and usher in four centuries of genocide that culled them to virtual extinction. Within a generation of Columbus landing, perhaps only 5-10 per cent of the entire American Indian population remained.

Ten years after Columbus landed on Hispaniola its indigenous people were extinct. Columbus in correspondance to his royal sponsors in Spain said they were “loving, uncovetous people,” with “good features and beautiful eyes,” who “neither carried weapons nor understood the use of such things.” Yet many were tortured to death in a vain attempt to get them to reveal non-existent hoards of gold and others worked to death or driven to suicide. Such gratuitous violence continued as Europeans extended their domains in the “New World.” (The Real First World War)

Many of the smaller tribes followed the Arawak of Hispaniola into extinction while the populations of larger groups fell by as much as 85 percent, victims not only of indiscriminate violence but of induced famines and new diseases to which they had no immunity. The spread of smallpox through blankets distributed free to Native Americans and the wanton slaughter of the great herds of bison on which the “Plains Indians” depended for food, clothing and shelter were the most outrageous cases of genocide. Estimates of the numbers killed range up to 100 million.

Bonner: The Runaway Paper Money Bubble is a Laughing Matter

US stocks are still going up. Gold is still dillydallying…

Guest post by Bill Bonner / Rogue Economist

Gold is waiting to see what happens. Japan and the US are pumping up the monetary base – fast. But collectively, their balance sheets actually contracted by $415 billion in the first quarter – led by a $370 billion decline in the ECB’s balance sheet.

Result: slightly less paper money in the developed economies… and a slightly lower gold price. Seems logical. Seems sensible.

You see, since the start of the secular bull market in gold, there has been a nearly perfect correlation between the gold price and the rate of balance sheet expansion (aka money printing) at the Fed, the ECB, the Bank of England and the Bank of Japan.

You can see clearly it in this chart courtesy of our friends at the Sprott Group.

According to Sprott, for every extra $1 trillion in collective balance sheet expansion by these central banks, gold has risen $210 per ounce.

Gold is the world’s alternative money. It and bitcoins. New supply of paper money is expanding rapidly. New supplies of gold and bitcoins are much more stable.

But many mainstream pundits are sure the end of the secular bull market in gold is at hand.

Who knows? Maybe they’re right.

But it seems more likely that when the Japanese get their presses running hot, the price of gold will resume its upward climb.

Bernard von NotHaus awaits his sentencing for ‘domestic terrorism’

Bernard von NotHaus

“The thing that fires me up the most,” von NotHaus will say, “is this is what happens: When money goes bad, people go crazy. Do you know why? Because they can’t exist without value. Value is intrinsic in man.”

His name is Bernard von NotHaus, and he is a professed “monetary architect” and a maker of custom coins found guilty last spring of counterfeiting charges for minting and distributing a form of private money called the Liberty Dollar.

Mr. von NotHaus managed over the last decade to get more than 60 million real dollars’ worth of his precious metal-backed currency into circulation across the country — so much, and with such deep penetration, that the prosecutor overseeing his case accused him of “domestic terrorism” for using them to undermine the government.

Of course, if you ask him what caused him to be living here in exile, waiting with the rabbits for his sentence to be rendered, he will give a different account of what occurred.

From New York Times: Prison May Be the Next Stop on a Gold Currency Journey

“This is the United States government,” he said in an interview last week. “It’s got all the guns, all the surveillance, all the tanks, it has nuclear weapons, and it’s worried about some ex-surfer guy making his own money? Give me a break!”

The story of Mr. von NotHaus, from his beginnings as a hippie, can sound at times as if Ken Kesey had been paid in marijuana to write a script on spec for Representative Ron Paul. At 68, Mr. von NotHaus faces more than 20 years in prison for his crimes, and this decisive chapter of his tale has come, coincidentally, at a moment when his obsessions of 40 years — monetary policy, dollar depreciation and the Federal Reserve Bank — have finally found their place in the national discourse.

More missing gold ‘paranoia’?

Increasingly citizens and their representatives are becoming suspicious of where their gold reserves are being kept.

First Venezuela, then Germany, and now the Netherlands want their gold back. In the wake of this week’s ruling by the German Federal Accountability Office that Germany must repatriate and audit 150 tons of its gold reserves from the NY Fed over the next 3 years, a Netherlands citizens committee has filed a petition demanding that the Dutch Central Bank (DNB) release information ”on the quantity and storage location of the Netherlands’ physical gold, and on the extent and nature of the gold claims.”

In the words of one of the petitioners Tom Lassing: “The last years have seen a loss of trust in the financial system and we have been fooled a lot. So I say: Just let the central banks like DNB show the gold is really there.

Should the citizens committee be successful, we are confident they will discover the vast majority of the country’s gold reserves- 10th largest in the world at 612,000 kilograms, are held in the basement of the NY Fed.

As we have been saying for years ago, the rig up: Central banks and too-big-to-fail financial institutions will not be able to hide the fact that they do not hold the gold they claim to.

See more on this unfolding massive economic scandal-

Is there really any gold left in Fort Knox?

GERMANY TO REPATRIATE & AUDIT 150 TONS OF GOLD RESERVES FROM NY FED

Canadian mint cannot account for missing gold

——————————————–

Lynnea Bylund is managing director of Gandhi Legacy Tours, Director of Gandhi Worldwide Education Institute, founder of Catalyst House and has nearly three decades of experience in administration, marketing and business development. She was a nationally recognized spokeswoman for the emerging alternative video and information delivery industries. She has a degree in holistic health-nutrition from the legendary and controversial health educator and activist Dr. Kurt Donsbach, she is the founder of two not-for-profit small business-based wireless trade associations and has lobbied on Capitol Hill and at the FCC where she has spoken out strongly against the cable TV monopoly, illegal spectrum warehousing and ill-conceived congressional schemes to auction our nation’s precious airwaves to the highest bidder.

Lynnea Bylund is managing director of Gandhi Legacy Tours, Director of Gandhi Worldwide Education Institute, founder of Catalyst House and has nearly three decades of experience in administration, marketing and business development. She was a nationally recognized spokeswoman for the emerging alternative video and information delivery industries. She has a degree in holistic health-nutrition from the legendary and controversial health educator and activist Dr. Kurt Donsbach, she is the founder of two not-for-profit small business-based wireless trade associations and has lobbied on Capitol Hill and at the FCC where she has spoken out strongly against the cable TV monopoly, illegal spectrum warehousing and ill-conceived congressional schemes to auction our nation’s precious airwaves to the highest bidder.

Ms. Bylund is a founder and former CEO of a Washington DC telecommunications consulting and management company with holdings in several operating and developmental wireless communications systems and companies. In 1995 Lynnea became the first female in the world to be awarded a Broadband PCS operating permit – she was one of only 18 winners, along with Sprint, AT&T, and Verizon in the biggest cash auction in world history, raising a whopping $7.7 billion. Lynnea also spear-headed the successful effort to launch the first cable TV network in the South Pacific islands.

… > Follow Lynnea on: +LynneaBylund – Twitter – LinkedIn – FaceBook – Pinterest & YouTube

Is there enough gold to return to a gold standard?

The “Ron Paul” debate around a return to a gold standard is being revisited after the US Republican Party called for a commission to look at such a system. But there may be too little gold to restore the gold standard, says UBS economist Paul Donovan.

The “Ron Paul” debate around a return to a gold standard is being revisited after the US Republican Party called for a commission to look at such a system. But there may be too little gold to restore the gold standard, says UBS economist Paul Donovan.

With a gold standard, the regulatory scheme exchanges paper currency for gold at a fixed conversion rate, which would effectively put a set price on the dollar tied to gold. Fans say this would increase confidence in the currency by tying it to something that is in finite supply, thus hobbling the ability of central bankers to create debt-based money at will.

Amid the chorus of opposition to the gold standard, the argument that there is simply not enough gold to do this is well-aired. But that’s not quite the full story, according to Paul Donovan, an economist at UBS.

From The Telegraph UK –

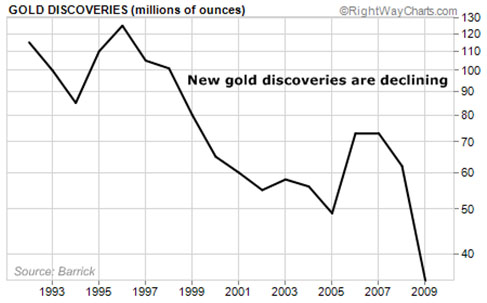

“More accurately, the supply of gold is not growing fast enough,” he says. “This is the fatal flaw.”

Pure US Fiat Money, Up In Smoke

As of this this week we have managed to survive four decades of US fiat money, and its anyone’s guess how much longer we can continue. Recently we read that the average life expectancy of a fiat currency is 27 years. The world’s oldest fiat currency, the British Pound, has survived nearly 318 years, but during this term it lost 99.5% of its initial value.

Given the undeniable track record of currencies, it is clear that on a long enough timeline the survival rate of all fiat currencies drops to zero.

And as Jeff Clark points out: History has a message for us: No fiat currency has lasted forever. Eventually, they all fail.

Since the ’70s gold has risen from $35 to $1740.

Edmund Conway at Daily Mail writes: On 15 August 1971, with the US public finances near broken by the cost of the war in Vietnam, Richard Nixon cut the final link between the US dollar and gold. Until then, the US Treasury was duty bound to exchange an ounce of gold with central banks willing to pay them $35. Suddenly, for the first time in history, the level of the world’s currencies depended not on the value of gold or some other tangible commodity but on the amount of trust investors had in that currency. Central banks were allowed to set monetary policy based on their instincts rather than on the need to keep their currency in line with gold.

It was one of those seminal moments whose significance has only gradually become apparent, obscured as it was at the time by Vietnam and then Watergate. But the more one examines economic history, the more obvious it is that this was one of the most important policy decisions in modern history.

The term fiat money has been defined variously as:

A- Any money declared by a government to be legal tender.

B- State-issued money which is neither convertible by law to any other thing, nor fixed in value in terms of any objective standard.

C- Money without intrinsic value.

D- All of the above.

The Gold War Has Begun!

Brace yourself for the impending gold shortage. Gold shortage? Yes. With the launch of a flurry of dedicated gold ETF’s last year, total ETF holdings of the barbaric relic, now exceed total world production. South Africa suffered its steepest decline in gold production since 1901, falling 14%, to a mere 232tons. It now ranks only third in global production of the yellow metal, after China and the US. Severe electricity rationing, a shortage of skilled workers, and more stringent mine safety regulations have been blamed.

From Goldprice.org –

The world is running low on gold and here’s more reasons why.

As the standard of living in China and India increases more and more people there will be demanding gold. As an example, the Chinese middle class has been increasing and although is a tiny percentage of the overall Chinese population it is still bigger than the entire population of the US now. The Chinese government is actively encouraging their population to buy gold. This is a lot of gold demand in China alone. The same is happening in India and their demand for gold is continuing to increase.

This is on top of the extra demand by cautious and impatient investors who are not getting the results they expect from bonds and investments.

The world’s biggest gold miner, Barrick Gold has noted that finding more and more viable gold deposits is becoming harder. The chart above shows how gold deposit discoveries are rapidly declining and we know what that means. The value of gold, quite apart from the decreasing dollar, is going to go up as demand outstrips supply.

The gold war has begun

You may be asking yourself, did the central banks ever control the gold market? Yes, indeed they did!

Is There Really Any Gold Left in Fort Knox?

In 2004 we wrote a series of articles in the Las Vegas Tribune questioning whether the world’s central banks were cooking their books regarding the amount of gold they held and why.* Much of our story told of the efforts of GATA, Gold Anti-Trust Action Committee, to expose the resultant gold-price manipulation that was occurring at the highest levels of the financial food chain.

*See: Where’s the Gold? and A Conspiracy of Gold

Now the Gold Anti-Trust Action Committee and its secretary/treasurer figure heavily in a new edition of the television program “Brad Meltzer’s Decoded,” which examines the question of whether the U.S. government really still has any gold in the vault at Fort Knox, Kentucky. The program, to be broadcast on the History Channel, stresses the secrecy and unaccountability of the government in regard to anything related to gold. Enjoy it here now!

——————————————–

Lynnea Bylund is a director of Gandhi Worldwide Education Institute, founder of Catalyst House and has nearly three decades of experience in administration, marketing and business development. She was a nationally recognized spokeswoman for the emerging alternative video and information delivery industries. She has a degree in holistic health-nutrition from the legendary and controversial health educator and activist Dr. Kurt Donsbach, she is the founder of two not-for-profit small business-based wireless trade associations and has lobbied on Capitol Hill and at the FCC where she has spoken out strongly against the cable TV monopoly, illegal spectrum warehousing and ill-conceived congressional schemes to auction our nation’s precious airwaves to the highest bidder.

Lynnea Bylund is a director of Gandhi Worldwide Education Institute, founder of Catalyst House and has nearly three decades of experience in administration, marketing and business development. She was a nationally recognized spokeswoman for the emerging alternative video and information delivery industries. She has a degree in holistic health-nutrition from the legendary and controversial health educator and activist Dr. Kurt Donsbach, she is the founder of two not-for-profit small business-based wireless trade associations and has lobbied on Capitol Hill and at the FCC where she has spoken out strongly against the cable TV monopoly, illegal spectrum warehousing and ill-conceived congressional schemes to auction our nation’s precious airwaves to the highest bidder.

Ms. Bylund is a founder and former CEO of a Washington DC telecommunications consulting and management company with holdings in several operating and developmental wireless communications systems and companies. In 1995 Lynnea became the first female in the world to be awarded a Broadband PCS operating permit – she was one of only 18 winners, along with Sprint, AT&T, and Verizon in the biggest cash auction in world history, raising a whopping $7.7 billion. Lynnea also spear-headed the successful effort to launch the first cable TV network in the South Pacific islands.

… > Follow Lynnea on: +LynneaBylund – Twitter – LinkedIn – FaceBook – Pinterest & YouTube

U.S. govt out to make forms of bartering illegal?

The U.S government may be positioning to establish private currency barter of any sort as an unlawful transaction, pursuant to a recent criminal conviction of Liberty Dollar’s founder Bernard Von NotHaus for “counterfeiting” and “conspiracy,” supposedly intending to illegally mint and replace US currency with a private one using silver and gold-based coins and silver-backed paper dollars.

See – Liberty Dollars Creator Convicted of Federal Crimes

And the US Attorney in charge of von NotHaus’s successful prosecution, is now parlaying the conviction to say that this ruling sets forth a precedent against “…any private barter transactions that use any form of currency besides established Federal Reserve Notes and U.S. minted coins.”

The federal government also is seeking to take permenant receipt of eight tons of silver and gold ($7+ Million dollars) bullion and silver ‘Liberty Dollars’ that were minted and sold by von NotHaus.

Contributing Editor – Las Vegas Tribune

by Lynnea Bylund 2004-2005

————-

THE ECONOMY

White House Small Business Agenda

HEALTH